(Complete Tax, Compliance & Business Comparison)

Foreign companies expanding into India — especially from markets like Germany — must carefully choose the right legal structure to optimise tax costs, regulatory compliance and long-term business scalability.

The three most common India entry options are:

✔ Branch Office

✔ Liaison Office

✔ Wholly-Owned Indian Subsidiary

Each has very different tax implications and compliance obligations.

This guide provides a clear, practical comparison to help foreign investors make the right decision.

🇮🇳 🇪🇺 India–EU Free Trade Agreement (FTA): Why This Is the Right Time to Enter India

With trade negotiations between India and the European Union progressing strongly, India is fast becoming a strategic hub for European investment.

The proposed FTA is expected to bring:

✅ Reduced trade barriers

✅ Greater market access for EU companies

✅ Investment protections

✅ Boost to manufacturing, technology & services

✅ Stronger India–Europe commercial ties

What this means for foreign businesses:

European companies are increasingly:

• Setting up Indian subsidiaries for manufacturing & sales

• Creating service & R&D centres

• Using India as an Asia operations base

👉 This makes choosing the right structure — Branch vs Subsidiary — more critical than ever to capture future FTA benefits while staying tax-efficient.

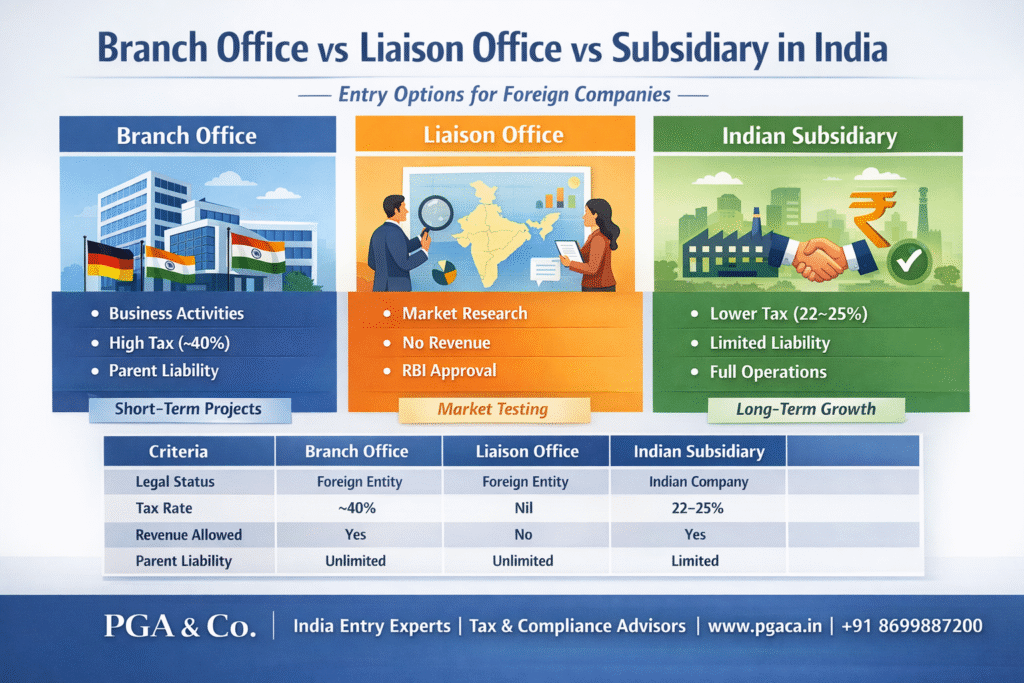

📊 Branch Office vs Liaison Office vs Subsidiary – Comparison Table

| Particulars | Branch Office | Liaison Office | Indian Subsidiary |

| Legal structure | Extension of foreign company | Extension of foreign company | Separate Indian company |

| RBI approval | Required | Required | Not required (FDI automatic route) |

| Commercial activity | Allowed | Not allowed | Fully allowed |

| Revenue in India | Yes | No | Yes |

| Permanent Establishment risk | Yes | Usually No | No |

| Tax status | Foreign company | Normally nil | Resident company |

| Effective tax rate | ~40% | Nil | ~22–25% (15% for manufacturing) |

| Profit repatriation | After tax | Not applicable | Dividend route |

| Parent liability | Unlimited | Unlimited | Limited |

| Compliance complexity | High | Medium | Medium |

| Best for | Projects | Market testing | Long-term business |

🏢 Branch Office in India – Advantages & Limitations

A Branch Office is treated as a Permanent Establishment (PE) of the foreign company in India.

✔ Advantages:

• Can carry on business activities

• Faster initial setup

• Profits can be remitted after tax

❌ Limitations:

• High income tax rate

• RBI regulatory restrictions

• Transfer pricing exposure

• Parent company bears full legal liability

📌 Ideal for:

Project-based work, engineering contracts, consulting assignments, short-term India presence.

📣 Liaison Office in India – Purely Exploratory Structure

A Liaison Office can only perform:

✔ Market research

✔ Promotion

✔ Communication & coordination

It cannot generate revenue.

📌 Ideal for:

Foreign companies testing the Indian market before committing investments.

🏭 Indian Subsidiary – The Most Efficient Long-Term Structure

An Indian subsidiary is a locally incorporated private limited company fully owned by the foreign parent.

✔ Key benefits:

• Lower corporate tax rates

• Limited liability protection

• No PE risk for parent

• Easier banking & contracts

• Eligible for government incentives

• Smooth scalability

📌 Ideal for:

Manufacturing, trading, IT services, SaaS, R&D centres and long-term India operations.

📈 Tax Impact – Why Most Companies Prefer Subsidiaries

| Structure | Approx Effective Tax |

| Branch Office | ~40% |

| Subsidiary | ~22–25% (15% tax for manufacturing entities) |

Even after dividend withholding tax, subsidiaries usually deliver higher post-tax profits than branches.

🎯 Which Structure Should You Choose?

| Business Goal | Best Option |

| Market exploration | Liaison Office |

| Short-term contracts | Branch Office |

| Long-term expansion | Subsidiary |

| Lower tax cost | Subsidiary |

| Risk control | Subsidiary |

✅ Final Expert Recommendation

For most foreign companies entering India:

Setting up an Indian subsidiary is the most tax-efficient, scalable and legally secure option. However, at times generally for limited project based operation, branch offices or liaison offices are also useful as it is easy to close the branch or liaison office than a subsidiary entity.

📞 Need Professional India Entry Structuring?

At PGA & Co. Chartered Accountants, we help foreign companies with:

✅ RBI & FEMA approvals

✅ Company incorporation in India

✅ Tax planning under DTAA

✅ Branch vs subsidiary structuring

✅ Ongoing compliance & advisory

👉 Book a Free India Entry Consultation

Email: info@pgaca.in

Contact: +91-86998 87200

Or fill our Contact Form on the website.