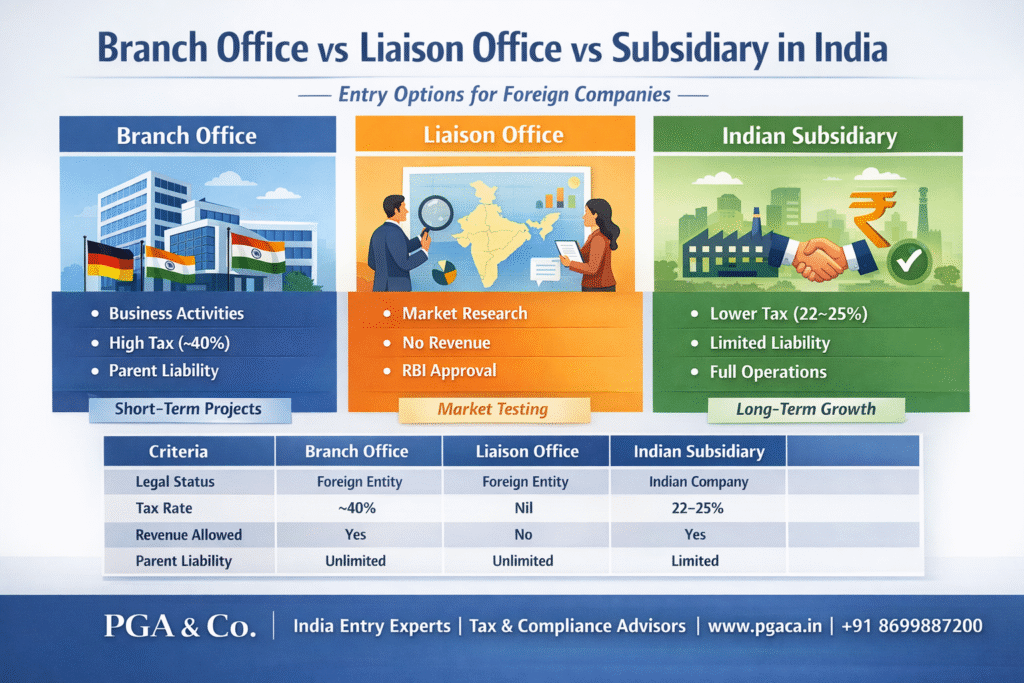

Branch Office vs Liaison Office vs Subsidiary in India -Best Entry Structure for Foreign Companies

Branch Office vs Liaison Office vs Subsidiary structures for foreign companies entering India. Learn tax impact, compliance, profit repatriation and best option for long-term growth.

Why Filing ITR Is Mandatory Even If Your Income Is Below ₹2.5 Lakh in Some Cases

Think you’re exempt from filing your Income Tax Return (ITR) because your income is below ₹2.5 lakh? Think again. While most people associate tax returns with high earners, the Income Tax Act has several lesser-known rules that make ITR filing mandatory—even if you fall below the basic exemption limit. From big-ticket transactions to foreign travel […]

EPF, PPF, NPS: Which Investment Gives the Best Tax Benefit in 2025?

When it comes to saving taxes and building long-term wealth in India, few investment options inspire more trust than the Employees’ Provident Fund (EPF), Public Provident Fund (PPF), and the National Pension System (NPS). These government-backed schemes are not only low-risk and secure—they also offer powerful tax-saving benefits under Section 80C and beyond. But in […]

How to Save Tax Legally in 2025: Tips for Salaried Employees & Freelancers

Taxes are inevitable—but paying more than you should isn’t.Every year, thousands of salaried professionals and freelancers unknowingly miss out on legitimate tax-saving opportunities simply because they aren’t aware of the full range of deductions, exemptions, and smart planning tools available under the Indian Income Tax Act. With the financial year 2024–25 in full swing, it’s […]

Startup Tax Benefits in 2025: Understanding Section 80-IAC and More

Launching a startup in India in 2025? You’re stepping into one of the world’s fastest-growing entrepreneurial landscapes. With over 100,000 startups officially recognized by DPIIT (Department for Promotion of Industry and Internal Trade), India is fostering innovation like never before. But beyond funding and scaling, strategic tax planning plays a key role in startup success. […]

How to File Your ITR Online Without a CA (And When You Absolutely Need One)

Filing your Income Tax Return (ITR) in India doesn’t have to be complicated — or expensive. Thanks to the government’s easy-to-use e-filing portal, many individuals with simple income sources can now file their returns online without needing to hire a Chartered Accountant (CA). But let’s be honest! taxes aren’t always straightforward. A small mistake today […]

Tax Filing Guide for NRIs: How to Avoid Double Taxation in India (Updated 2025)

For many Non-Resident Indians (NRIs), managing taxes across two countries is more than just a paperwork hassle—it’s a financial tightrope. With income sources spread across borders, one of the most pressing challenges is double taxation: getting taxed in both India and your country of residence on the same earnings. But here’s the good news: India’s […]

When Does a Non-Resident Become a Resident for Tax Purposes? (With Examples)

With increasing global mobility, many Indians living abroad ask: “Am I still a Non-Resident for tax purposes in India?” The answer depends not on your citizenship but on your residential status as defined by Indian tax laws. This classification directly impacts what income you must report and pay tax on in India. Understanding when an […]

Time Limit for Issuing GST Notices in India: A Complete 2025 Guide

Navigating India’s Goods and Services Tax (GST) regime requires more than just timely return filing. It demands a solid understanding of the law, especially when it comes to departmental scrutiny. As GST evolves, one area that continues to catch taxpayers off guard is the issuance of GST notices, often triggered by discrepancies, audits, or compliance […]

Time Limit for Issuing Income Tax Notices in India (Updated 2025)

When it comes to income tax compliance in India, timing isn’t just important—it’s everything. Whether you’re a salaried individual, a startup founder, or managing a growing enterprise, understanding the statutory time limits for income tax notices can protect you from last-minute surprises and unnecessary penalties. Have you ever wondered—How long after filing can the Income […]

5% Tax on Remittances to India? What NRIs, H-1B, F-1, J-1, and Green Card Holders Must Know

Introduction A new U.S. legislative proposal has sparked widespread concern among Indian expatriates, especially those working under H-1B, F-1, and other non-immigrant visas. Titled the “Big Beautiful Bill,” this proposed law seeks to impose a 5% tax on international remittances made by non-U.S. citizens. For Indian residents abroad who routinely send money to family or […]

Top Benefits of Filing Your Income Tax Return Early (Beyond Just Avoiding Penalties)

Filing your Income Tax Return (ITR) might feel like a tedious annual obligation, but doing it early—well before the deadline—comes with a host of hidden advantages. While most taxpayers rush to meet the last date to avoid late filing fees, seasoned professionals and financially savvy individuals know that early ITR filing can actually be a […]

ITR FILING GUIDE 2025: Learn All About 7 ITR Forms in India

Income Tax Return (ITR) filing is a critical annual obligation for individuals and businesses in India. Selecting the correct ITR form ensures compliance, avoids penalties, and facilitates smooth tax assessments. With the Assessment Year 2025–26 underway, this guide aims to simplify the complexities of ITR forms and help you determine the right form for your […]

5 years of Faceless assessment in India, Is Faceless Assessment a Success or Failure?

In 2020, the Indian government launched the Faceless Assessment scheme to revolutionize income tax proceedings. The objective was clear: eliminate human interaction, reduce corruption, and ensure faster, fairer tax assessments through a digital framework. Nearly five years later, India’s faceless tax system remains one of the most debated reforms in the country’s fiscal history. So, has it been a success—or […]

Upcoming Changes in TDS Provisions – Effective from April 1, 2025

The Indian government has proposed significant changes to the Tax Deducted at Source (TDS) provisions under the Income Tax Act, effective from April 1, 2025. These amendments aim to simplify tax compliance, rationalize threshold limits, and reduce TDS rates to improve the ease of doing business. As a leading Income Tax consultants, PGA & Co. […]